Let’s be honest. Investing can feel like a cold numbers game. Spreadsheets, quarterly reports, volatile charts. But what if your portfolio could reflect something more? Something like, well, your actual values.

That’s the core idea behind a values-based portfolio. And right now, one of the most compelling—and complex—areas to apply it is in ethical artificial intelligence development. It’s not just about avoiding the “bad” stuff. It’s about actively seeking out and supporting companies trying to build AI the right way. The human way.

Why Ethical AI Isn’t Just a Buzzword

You’ve seen the headlines. Bias in hiring algorithms. Deepfake scandals. Opaque decision-making that affects lives. The public’s trust is, frankly, a bit shaky. And that creates a real business risk.

For investors, this shifts ethical AI from a nice-to-have CSR initiative to a critical component of long-term viability. A company that bakes ethics into its AI development process is likely mitigating regulatory, reputational, and operational risks down the line. They’re building a more resilient product—and business.

The Pillars of an Ethical AI Investment Framework

Okay, so how do you spot these companies? You can’t just take their marketing at face value. You need to dig a little. Look for concrete actions around a few key pillars.

- Transparency & Explainability: Do they disclose how their AI models are built and trained? Is there an effort to make outputs understandable, not just inscrutable “black boxes”?

- Bias Mitigation: What active steps are they taking to identify and reduce bias in data and algorithms? This is a process, not a one-time fix.

- Privacy by Design: Is user data protection a core architectural principle, or an afterthought?

- Human Oversight & Accountability: Are there clear human-in-the-loop systems? Who is ultimately accountable for the AI’s decisions?

- Societal & Environmental Benefit: Honestly, is the application of the AI solving a real problem without causing undue harm? What’s its carbon footprint?

Mapping Your Portfolio: Sectors and Opportunities

Ethical AI isn’t confined to one industry. It’s a lens through which to view many sectors. Here’s where things get interesting.

| Sector | Ethical AI Focus | Investment Example |

| Healthcare | Diagnostic tools that are auditable for bias; patient data privacy. | Medical imaging firms with diverse training datasets. |

| Finance | Fairness in credit scoring; transparent fraud detection. | Fintechs using explainable AI for loan approvals. |

| Enterprise Software | Responsible automation that augments, not just replaces, jobs. | CRM/platform companies with strong AI ethics boards. |

| Semiconductors | Hardware efficiency for sustainable AI compute. | Chip designers prioritizing low-power AI accelerators. |

The trick is to look for companies where ethical AI is a competitive moat, not just a side project. It’s woven into their product story.

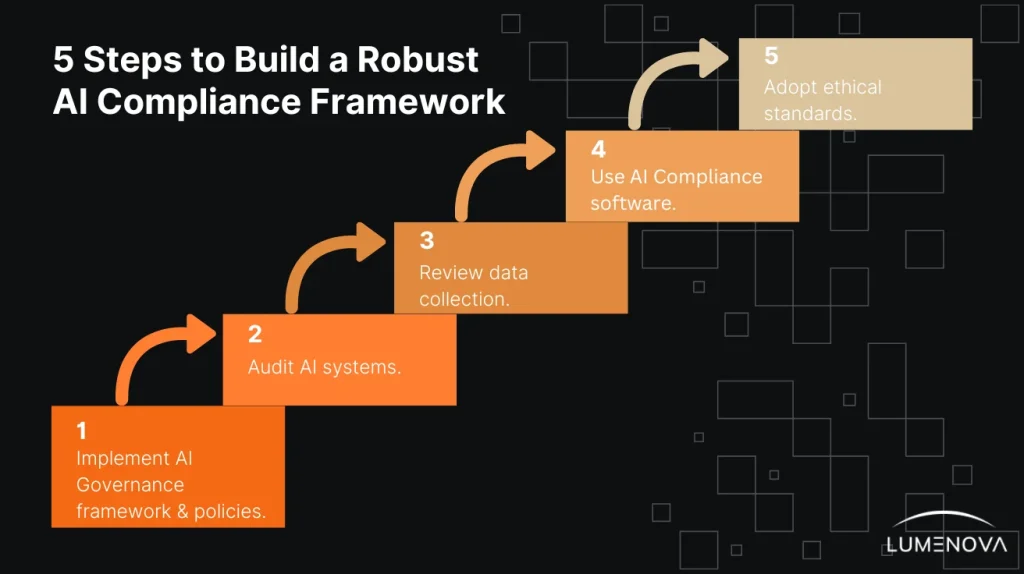

The Practical Steps: How to Actually Start

Feeling overwhelmed? Don’t be. You start the same way you eat an elephant—one bite at a time. Here’s a simple roadmap.

- Screen Your Current Holdings. Use the pillars above as a checklist. Read the “AI” or “Responsible Innovation” section of their annual reports. What are they actually saying?

- Look Under the Hood of ETFs & Funds. There are a growing number of ESG and tech funds with an AI focus. Drill into their top holdings. Do they align with your ethical AI criteria, or are they just broad tech baskets?

- Engage and Ask Questions. As a shareholder, you can attend AGMs or submit questions. Ask about diversity in AI teams, about audit processes, about their stance on government AI regulations. Their answers—or lack thereof—tell you everything.

- Accept Imperfection. This is a nascent field. No company is perfect. You’re looking for progress, commitment, and transparency over polished perfection. A company that admits its challenges is often more credible than one claiming to have all the answers.

The Inevitable Challenges (And How to Think About Them)

Sure, this path has its bumps. “Ethics” can be subjective. Greenwashing has a techy cousin called “ethics-washing.” And sometimes, the financial returns of a purely ethical AI portfolio might… well, they might look different in the short term.

That’s the real test of values-based investing, isn’t it? It requires a longer time horizon. You’re betting on a future where responsible innovation wins. Where trust becomes a tangible asset. Frankly, where good tech is also good business.

The landscape is shifting. Regulations like the EU AI Act are coming. Public scrutiny is intensifying. The companies ahead of this curve aren’t just doing the right thing—they’re positioning themselves for a world where it’s the only sustainable thing.

Beyond the Spreadsheet: The Ripple Effect

At its heart, building this kind of portfolio is a statement. It’s capital voting for a particular version of the future. One where technology serves humanity, not the other way around.

Each investment becomes a small signal to the market. A demand for accountability. A bet on human-centric design. It connects your financial goals to a broader vision—a world where AI helps cure diseases, fight climate change, and unlock potential, all while respecting the dignity and rights of individuals.

That’s a return that doesn’t always show up on a quarterly statement. But you know it’s there.

About Author

You may also like

-

Investing in the Creator Economy and Digital Goods: The New Frontier of Value

-

Strategic Asset Allocation: The Financial Engine for a Longer, Healthier Life

-

ESG Investment Frameworks for Small Businesses: A Practical Guide

-

The Role of Emergency Funds in Managing Investment and Loan Risk

-

Understanding and Applying the Concept of Socially Responsible Investing